Budgeting is a fundamental financial skill, and it helps individuals and households manage their income and expenses effectively. Without a proper budget, financial stability becomes difficult to achieve. Moreover, a structured approach to budgeting allows people to make better financial decisions while reducing unnecessary expenses and ensuring savings for future needs. So, understanding the basics of budgeting is essential for financial success and security.

Understanding Budgeting

Budgeting refers to the process of creating a plan for managing money by tracking income and expenses. This plan helps allocate funds appropriately to meet financial goals. By following a budget, individuals gain better control over their finances, preventing overspending and fostering responsible money management. A budget acts as a financial roadmap, providing clear insights into spending patterns and savings opportunities.

The Importance of Budgeting

Budgeting plays a crucial role in financial health. It helps avoid debt accumulation, ensures timely bill payments, and allows for savings growth. Without a budget, managing financial obligations becomes challenging, leading to stress and uncertainty. A well-structured budget promotes financial discipline, supporting long-term goals such as home ownership, retirement savings, and emergency funds.

Key Components of a Budget

A successful budget consists of various essential elements. The first component is income, which includes salary, wages, freelance earnings, and passive income sources. The second component is expenses, which are categorized into fixed and variable costs. Fixed expenses include rent, mortgage payments, and insurance premiums, while variable expenses cover groceries, entertainment, and travel. Another important aspect is savings, which should be prioritized to build financial security. Emergency funds, investments, and retirement savings must be factored into the budgeting process.

Steps to Create a Budget

The process of creating a budget begins with assessing financial resources. Identifying income sources and understanding spending habits is the first step. The next step involves listing all expenses, ensuring every financial commitment is accounted for. Categorizing expenses helps distinguish between essential and non-essential spending. Setting financial goals is another critical step, allowing for strategic planning to meet short-term and long-term objectives. Finally, monitoring and adjusting the budget regularly ensures that financial plans remain effective and relevant.

Common Budgeting Methods

Various budgeting methods cater to different financial needs and preferences, and each offers unique benefits. For instance, the 50/30/20 rule is a popular approach since it allocates 50% of income to necessities, 30% to discretionary spending, and 20% to savings. Meanwhile, the envelope system involves using cash for specific spending categories, which helps prevent overspending. On the other hand, zero-based budgeting requires assigning every dollar a purpose, ensuring complete financial control. Therefore, selecting the right budgeting method depends on individual financial goals and lifestyle choices.

Avoiding Common Budgeting Mistakes

Budgeting mistakes can seriously hinder financial progress, so it’s important to be aware of common pitfalls. For example, underestimating expenses often leads to financial shortfalls, making it harder to stay on track. Likewise, failing to adjust the budget according to changes in income or expenses can create unnecessary financial strain. Plus, ignoring savings in a budget results in financial vulnerability, leaving little room for emergencies. And let’s not forget impulse spending—it can easily disrupt a budget, which is why distinguishing between needs and wants is crucial. Therefore, consistently reviewing financial plans helps prevent budgeting errors and ensures long-term financial stability.

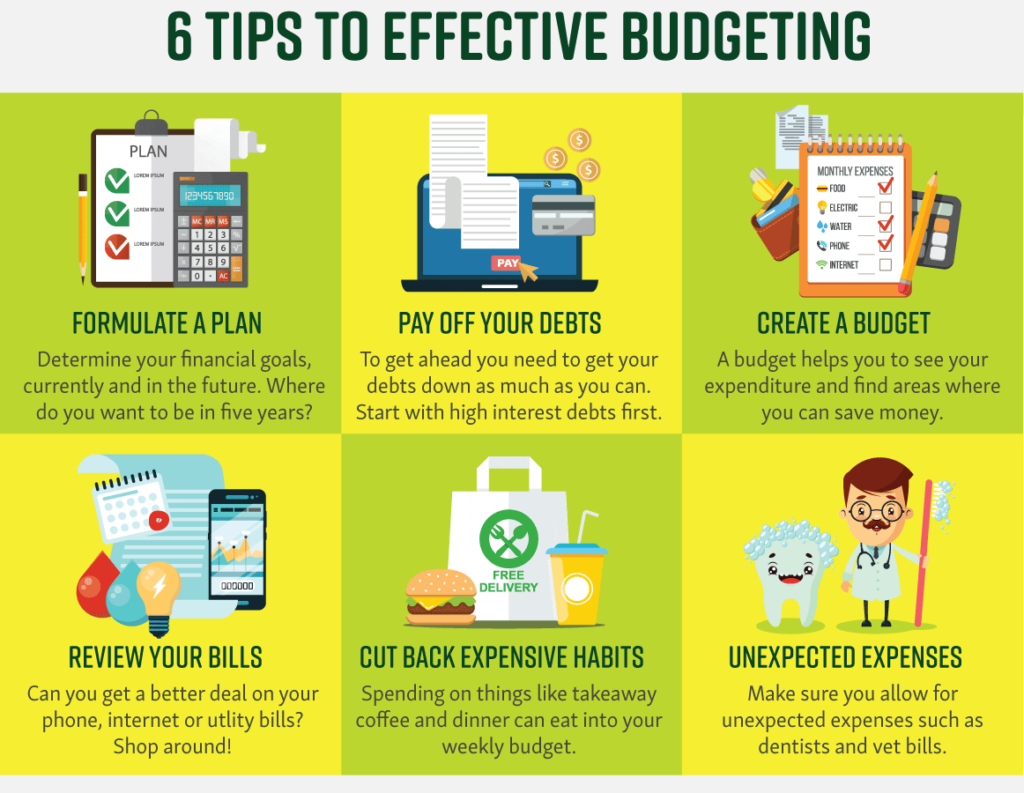

Tips for Successful Budgeting

Successful budgeting requires discipline and commitment, so staying consistent is key. Regularly tracking expenses provides valuable insights into spending habits, allowing for necessary adjustments. Plus, using budgeting tools and apps simplifies financial planning, making it much easier to stick to a budget. Also, setting realistic financial goals ensures motivation and steady progress. Not to mention, practicing mindful spending helps reduce unnecessary purchases, freeing up more funds for savings and investments. Therefore, reviewing the budget monthly fosters continuous improvement in financial management and keeps financial goals on track.

The Role of Budgeting in Achieving Financial Freedom

Financial freedom is attainable through effective budgeting. Proper money management leads to reduced debt, increased savings, and financial independence. Budgeting enables individuals to make informed financial decisions, securing a stable future. A well-maintained budget supports investment opportunities, homeownership, and a comfortable retirement. The discipline gained from budgeting extends beyond finances, fostering responsible decision-making in various life aspects.

Conclusion

Budgeting is a fundamental skill that promotes financial stability and success. By understanding the basics of budgeting and implementing effective strategies, individuals gain better control over their finances. Avoiding common budgeting mistakes and adopting a structured approach ensures a balanced financial life. With consistent effort and discipline, budgeting becomes a powerful tool for achieving financial freedom and long-term security. Mastering budgeting today paves the way for a financially sound future.