Imagine enjoying life’s best moments without constantly worrying about your bank balance. What if saving money felt just as thrilling as spending it?

Saving money doesn’t have to mean giving up everything enjoyable. With the right strategies, you can cut costs while still having an exciting and fulfilling life. Furthermore, by making small yet impactful changes, financial stability becomes easier to achieve. This article explores scientifically-backed ways to manage finances wisely while maintaining a fun lifestyle. Additionally, these approaches ensure that saving money never feels like a sacrifice.

The Psychology of Spending and Saving

Understanding Spending Habits

Human psychology plays a crucial role in spending behavior. In many cases, impulse purchases often result from emotional triggers rather than necessity. For example, feelings of stress, excitement, or even boredom can lead to unplanned spending. Moreover, research shows that identifying these triggers helps in controlling unnecessary expenses. By recognizing the emotions driving purchases, individuals can make more mindful financial decisions. Consequently, this awareness allows for better budgeting and ultimately leads to greater financial stability.

The Role of Dopamine in Financial Decisions

Dopamine, the brain’s pleasure chemical, influences buying decisions. When making a purchase, dopamine levels spike, creating a sense of excitement. Consequently, this surge in pleasure often leads to impulsive spending. Instead of spending impulsively, however, redirecting that excitement toward savings can be beneficial. For instance, gamifying the saving process, such as using apps that reward savings goals, can help in achieving this shift. As a result, individuals can experience the same thrill while making financially sound decisions.

Delayed Gratification and Its Impact

A famous study on delayed gratification, the Stanford Marshmallow Experiment, revealed that individuals who practice patience tend to have better financial stability. Training the brain to delay rewards helps in building long-term wealth without missing out on life’s pleasures.

Smart Budgeting Techniques That Work

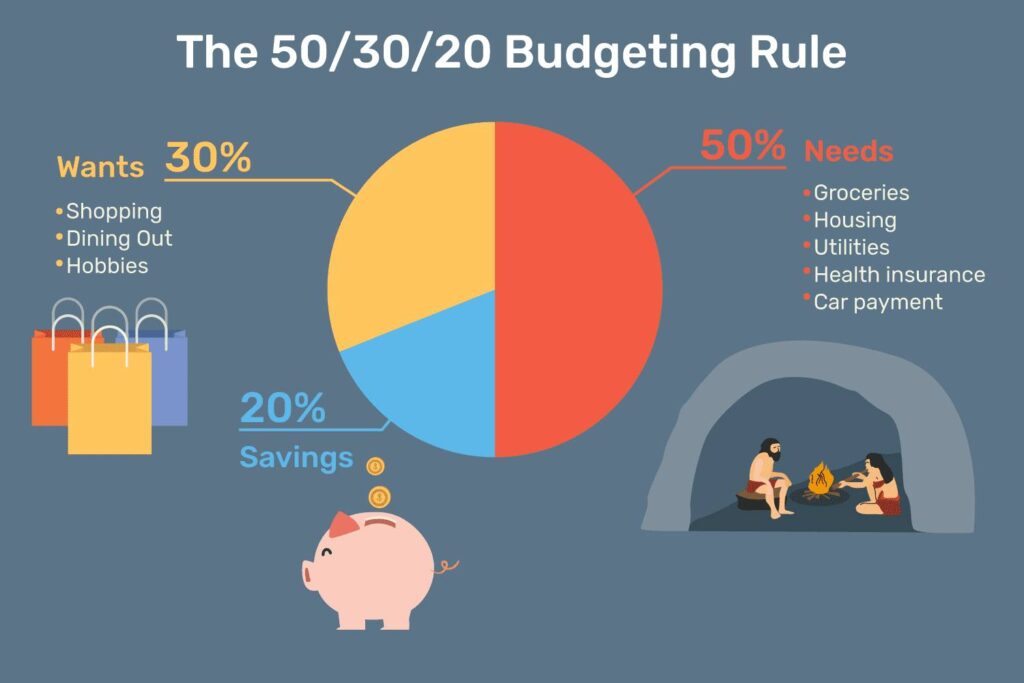

The 50/30/20 Rule

This budgeting method suggests allocating 50% of income to necessities, 30% to wants, and 20% to savings.

50%: Needs

Needs are the bills that you absolutely must pay and things that are necessary for survival. Half your after-tax income should be all you need to cover those needs and obligations .

Consider either cutting down on wants or trying to downsize your lifestyle if you’re spending more than 50% on your needs.Examples of needs include but aren’t limited to:

- Rent or mortgage payments

- Car payments

- Groceries

- Insurance and health care

- Minimum debt payments

- Utilities

30%: Wants

Wants are the things you spend money on that aren’t absolutely essential. You can work out at home instead of going to the gym or watching sports on TV instead of getting tickets to the game.

This category also includes those upgrade decisions you make such as choosing a costlier steak instead of a less expensive hamburger, buying a Mercedes instead of a more economical Honda, or choosing between watching television using an antenna for free or spending money to watch cable TV. Wants are all those extras you spend money on that make life more enjoyable and entertaining. Examples of wants include but aren’t limited to:

- Unnecessary clothing or accessories like handbags or jewelry

- Tickets to sporting events

- Vacations or other non-essential travel

- The latest electronic gadget, especially an upgrade over the fully functioning model you already have

- Ultra-high-speed internet beyond your streaming needs

20%: Savings

Try to allocate 20% of your net income to savings and investments. You should have at least three months of emergency savings on hand in case you lose your job or an unforeseen event occurs.2 Focus on retirement and meeting more distant financial goals after that. Examples of savings can include:

- Creating an emergency fund

- Setting aside funds to buy physical property for long-term holding

- Making debt repayments beyond minimum payments

By maintaining a structured financial plan, one can enjoy entertainment and hobbies without guilt.

Reverse Budgeting

A reverse budget is another name for “paying yourself first.” When you create a reverse budget, you prioritize putting money into savings. Once you meet your savings goals, you use what’s leftover for expenses and spending.Rather than spending first and saving later, reverse budgeting prioritizes savings before discretionary expenses. This ensures that financial goals are met while still allowing room for enjoyable activities.

The Envelope System

The envelope system, also known as the envelope budgeting method or cash stuffing, is a popular personal budgeting method for visualizing and maintaining a flexible budget. The key idea is to prioritize cash income to meet separate categories of household expenses in physically separate envelopes.A cash-based approach like the envelope system prevents overspending. Allocating cash to different spending categories ensures better financial control while still permitting fun expenditures.

Finding Enjoyment Without Overspending

Affordable Travel Hacks

Many people assume that traveling on a budget means missing out on exciting experiences, but that’s far from the truth. With smart planning and strategic choices, you can explore new destinations without overspending. One of the most effective ways to save money is by booking flights during off-peak seasons when ticket prices drop significantly. Additionally, taking advantage of airline reward points or travel credit card perks can lead to free or discounted flights. Choosing budget-friendly accommodations, such as hostels, vacation rentals, or even house-sitting opportunities, also helps cut costs without compromising comfort. By planning ahead and making informed choices, you can enjoy enriching travel experiences while keeping expenses under control.

Free and Low-Cost Entertainment Options

Enjoying entertainment doesn’t have to come with a hefty price tag. Most cities offer a variety of free or low-cost activities that allow you to have fun without stretching your budget. Public concerts, outdoor movie screenings, and free museum days provide great opportunities to experience local culture without spending a dime. Additionally, exploring parks, hiking trails, and other nature-based attractions offers both relaxation and adventure at little to no cost. By keeping an eye on community events and local festivals, you can maintain an active social life while staying within budget.

Dining Out on a Budget

Eating out can quickly become expensive, but with a few strategic approaches, you can enjoy restaurant meals without financial strain. Choosing happy hour specials, lunch deals, or early bird discounts allows you to savor delicious food at reduced prices. Additionally, using discount apps and loyalty programs can unlock exclusive deals and cashback offers. Another smart tactic is to share meals or opt for smaller portions, which not only cuts costs but also prevents food waste. By planning your dining experiences wisely, you can indulge in great food without overspending..

Leveraging Technology for Smarter Savings

Budgeting Apps and Tools

Several apps, like Mint and YNAB, help track expenses and suggest areas to cut costs. These digital solutions automate savings while providing insights into spending habits.

Cashback and Reward Programs

Using cashback credit cards and reward programs maximizes savings on everyday purchases. Strategic use of these benefits can lead to significant cost reductions over time.

Subscription Management

Many people subscribe to multiple services they rarely use. Regularly reviewing and canceling unnecessary subscriptions can free up money for more enjoyable activities.

The Power of Mindful Spending

Needs vs. Wants

Understanding the difference between needs and wants plays a crucial role in financial well-being. By carefully evaluating purchases, individuals can avoid unnecessary expenses and prioritize essentials. Moreover, asking whether a purchase aligns with long-term goals fosters better decision-making. As a result, people can save more money while still enjoying meaningful experiences.

The 24-Hour Rule

Pausing for 24 hours before making a non-essential purchase helps curb impulse spending. During this time, individuals can reassess whether the item truly adds value to their lives. Additionally, this practice fosters mindfulness, making people more intentional with their money. Ultimately, implementing this rule leads to smarter financial choices and greater long-term savings.

Practicing Gratitude

Embracing gratitude allows individuals to find contentment in what they already own, reducing the urge to buy unnecessary items. Research suggests that grateful people experience higher levels of happiness and lower levels of materialism. Furthermore, shifting the focus from accumulating possessions to appreciating experiences leads to more fulfilling financial decisions. Over time, this mindset fosters a healthier relationship with money and enhances overall well-being.

Socializing Without Financial Strain

Hosting Budget-Friendly Gatherings

Rather than dining out frequently, consider hosting potlucks and game nights at home. These gatherings not only create a warm and inviting atmosphere but also significantly cut down on expenses. By encouraging each guest to contribute a dish or game, you ensure a diverse and enjoyable experience without the financial burden falling on one person. Additionally, hosting at home allows for deeper connections and more meaningful conversations, making every get-together memorable.

Group Discounts and Memberships

To make entertainment more affordable, take full advantage of group discounts, loyalty programs, and memberships. Many cinemas, gyms, and event organizers offer special pricing for groups or subscribers. By planning outings with friends or family, you can split costs and enjoy the same experiences at a fraction of the price. Additionally, signing up for memberships often unlocks exclusive deals, priority access, and long-term savings, making every leisure activity more budget-friendly.

Alternative Gift-Giving Strategies

Instead of spending excessively on material gifts, consider more meaningful and cost-effective alternatives. Handmade gifts, personalized experiences, or skill-based offerings often carry greater sentimental value than store-bought items. Whether it’s a heartfelt letter, a home-cooked meal, or a DIY craft, these thoughtful gestures create lasting memories. Not only do they reduce financial stress, but they also add a personal touch that makes special occasions even more cherished.

Investing in Experiences Over Material Possessions

Science-Backed Benefits of Experiences

Studies consistently show that people derive more happiness from experiences than from material goods. Unlike possessions, which lose their novelty over time, experiences become cherished memories that contribute to long-term well-being. Traveling to new places broadens perspectives, learning new skills fosters personal growth, and engaging in social activities strengthens relationships. Since experiences often involve shared moments with others, they also enhance emotional connections, making them even more valuable than any tangible item.

Prioritizing Meaningful Activities

Choosing activities that align with your passions and values ensures that every experience is fulfilling. Instead of spending money on unnecessary purchases, investing in hobbies, personal development, or quality time with family and friends leads to greater satisfaction. Whether it’s attending a concert, joining a creative workshop, or simply spending a peaceful evening outdoors, prioritizing meaningful activities ensures that your time and money are used wisely. By focusing on quality over quantity, you can create a lifestyle centered around joy and purpose.

Minimalism as a Lifestyle Choice

Embracing minimalism doesn’t just declutter your living space—it also simplifies your finances and overall lifestyle. By reducing unnecessary purchases and focusing only on essentials, you free up financial resources for experiences that truly matter. A minimalist mindset encourages intentional living, where every expense aligns with your values and long-term goals. Instead of accumulating material goods, directing money toward travel, education, and personal growth leads to a richer and more fulfilling life.

A penny saved is a penny earned.

Benjamin Franklin

Conclusion

Achieving financial stability while still enjoying life isn’t just a dream—it’s entirely possible with the right mindset and smart strategies. Instead of viewing budgeting as a limitation, think of it as a tool that empowers you to make intentional choices. By recognizing psychological triggers that lead to unnecessary spending, you can develop healthier financial habits that align with your long-term goals.

At the same time, implementing practical budgeting techniques—such as tracking expenses, setting spending limits, and taking advantage of discounts—ensures that you get the most value out of every dollar. Prioritizing experiences over material possessions also plays a crucial role in maintaining both financial well-being and personal fulfillment. Investing in travel, learning, and shared moments creates lasting memories that far outweigh the temporary satisfaction of impulse purchases.

Ultimately, financial freedom isn’t about cutting out all enjoyment; it’s about making mindful choices that support both present happiness and future security. By finding a balance between spending and saving, you can lead a fulfilling life without unnecessary financial stress. The key lies in adopting sustainable habits, staying disciplined, and embracing a lifestyle that values experiences over excess.