This comprehensive guide to investing for beginners breaks down essential concepts, strategies, and practical steps to start building wealth. It explores key principles like diversification, risk management, and the power of compounding while offering insights into various investment options such as stocks, bonds, mutual funds, and real estate. With a focus on long-term success, this article helps readers navigate the financial markets with confidence, avoid common pitfalls, and develop a solid investment strategy.

Introduction

Investing is a powerful way to grow wealth over time. However, for beginners, the world of investing can seem complex and overwhelming. Fortunately, understanding the basics can make the process easier. Since financial security is a common goal, knowing where to start is crucial. This article explores key investing principles, essential strategies, and practical tips to help beginners confidently enter the investment world.

Understanding the Basics of Investing

What is Investing?

Investing involves putting money into assets with the expectation of generating returns. In contrast to saving, which prioritizes security, investing seeks growth. Typically, investments include stocks, bonds, mutual funds, and real estate. Therefore, understanding different investment options is essential before making decisions.

Why Should You Invest?

Investing helps combat inflation, build wealth, and secure financial independence. In fact, money kept in a savings account may lose value over time due to inflation. By investing, individuals can potentially earn higher returns, ensuring their financial stability. Moreover, a well-planned investment strategy can provide long-term security and passive income.

Key Investment Principles

Risk and Return

Every investment carries some level of risk. Higher-risk investments often provide greater potential returns. On the other hand, lower-risk options offer stability but may grow slowly. Therefore, balancing risk tolerance with financial goals is critical.

The Importance of Diversification

Diversification reduces risk by spreading investments across different asset classes. Consequently, if one investment underperforms, others may compensate. A diversified portfolio, as a result, increases the chances of steady returns over time.

The Power of Compounding

Compounding allows investments to grow exponentially over time. Essentially, reinvesting earnings generates additional returns, creating a snowball effect. This is why starting early provides significant advantages. Even small investments, when compounded, can grow substantially over decades.

Steps to Start Investing

Setting Clear Financial Goals

Before investing, define specific financial objectives. For instance, short-term goals may include saving for a car, while long-term goals could involve retirement planning. Having clear goals, therefore, guides investment choices and risk tolerance.

Understanding Investment Accounts

Different accounts serve different purposes. Brokerage accounts offer flexibility, while retirement accounts, such as IRAs and 401(k)s, provide tax advantages. Consequently, choosing the right account depends on investment goals and financial planning.

Choosing Investment Vehicles

Investors can select from various assets, each with unique benefits.

Stocks

Stocks represent ownership in a company. Although stocks can be volatile, they historically offer high returns over the long term. Therefore, they are ideal for investors with a long time horizon.

Bonds

Bonds are debt securities issued by governments or corporations. They provide regular interest payments and are generally lower risk than stocks. As a result, they are suitable for conservative investors.

Mutual Funds and ETFs

Mutual funds and ETFs pool money from multiple investors to purchase diversified assets. Since they provide instant diversification, they are excellent for beginners. Additionally, they require less active management compared to individual stocks.

Real Estate

Real estate investing involves purchasing properties to generate rental income or capital appreciation. Though it requires more capital upfront, real estate can provide stable long-term returns. Moreover, it serves as a hedge against inflation.

Understanding Market Cycles

Markets fluctuate, and prices rise and fall. While downturns can be discouraging, they are a normal part of investing. Consequently, staying patient and maintaining a long-term perspective is essential.

The Role of Dollar-Cost Averaging

Dollar-cost averaging (DCA) involves investing a fixed amount at regular intervals. This strategy minimizes the impact of market volatility. Even during market declines, continuing to invest ensures purchasing assets at lower prices.

Managing Emotions in Investing

Investing can be emotional, especially during market downturns. However, making decisions based on fear or excitement often leads to mistakes. Therefore, focusing on long-term goals and sticking to a strategy helps investors stay on track.

Developing a Strong Investment Strategy

Active vs. Passive Investing

Active investors buy and sell frequently to capitalize on market trends. Meanwhile, passive investors follow a long-term approach, often using index funds. Since passive investing reduces fees and risk, it is often recommended for beginners.

Rebalancing Your Portfolio

Over time, portfolio allocations shift due to market performance. Regularly rebalancing ensures alignment with investment goals. For instance, if stocks outperform bonds, selling some stocks and buying bonds restores balance.

Seeking Professional Advice

While self-directed investing is possible, seeking financial advice can be beneficial. A financial advisor, in particular, can provide personalized guidance based on individual goals and risk tolerance.

Common Mistakes to Avoid

Trying to Time the Market

Predicting market movements is nearly impossible. Even experienced investors struggle with timing investments perfectly. Instead, staying invested for the long term generally yields better results.

Investing Without Research

Blindly following trends or tips can be risky. Researching assets, understanding fundamentals, and evaluating risks are crucial before making investment decisions.

Ignoring Fees and Taxes

Investment fees and taxes can reduce overall returns. Therefore, choosing low-cost funds and understanding tax implications helps maximize profits.

The stock market is filled with individuals who know the price of everything, but the value of nothing.

Philip Fisher

Conclusion

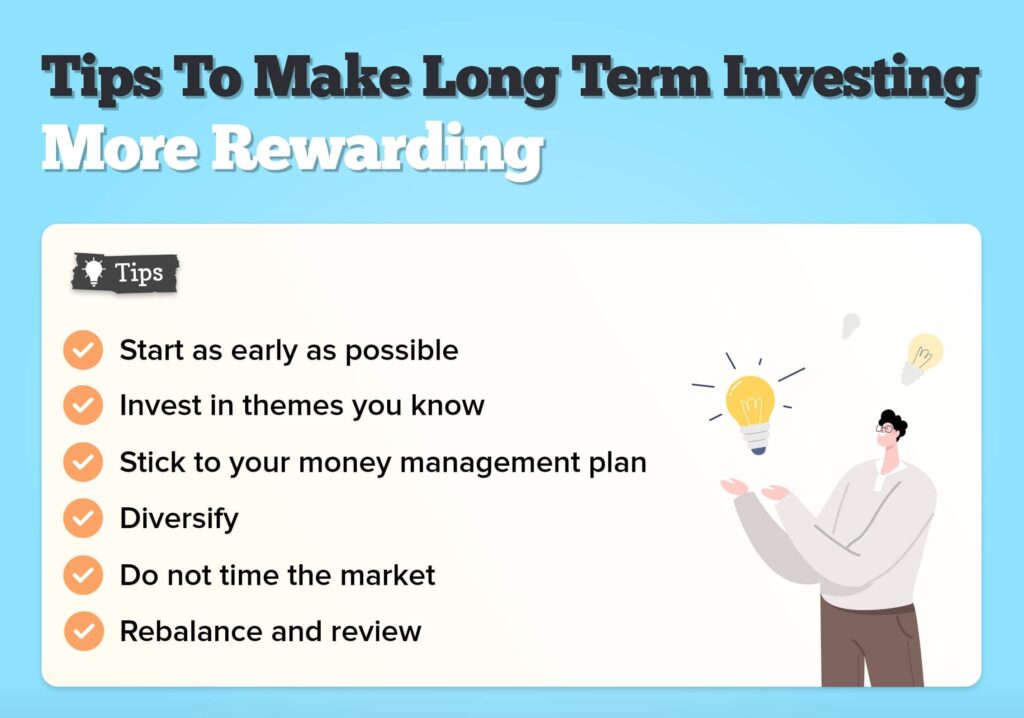

Investing can seem overwhelming at first, but following these strategies simplifies the process. Setting clear goals, diversifying investments, and staying patient are essential for long-term success. Moreover, understanding risk, leveraging compounding, and managing emotions contribute to smarter investment decisions. While challenges exist, disciplined investing ultimately leads to financial growth and security. As a result, beginners who start investing today can build a strong financial future.